Remote work gives many digital nomads the freedom to travel while working, but it also comes with a certain set of health risks. Getting sick or needing medical care in another country can be expensive and stressful without the right insurance.

That’s why digital nomad health insurance is so important, with many plans covering medical costs, providing access to quality hospitals, and facilitating visa requirements worldwide.

The best plans include emergency care, online doctor visits, and coverage for both short-term and long-term health needs. Companies like Pacific Prime make it easy for remote workers to stay protected and worry-free, no matter where they are in the world.

On this page

| Jump to Section | Description |

|---|---|

| The risks of uninsured remote work | Learn about the health risks associated with remote work, including medical emergencies, unreliable local healthcare, and high costs without insurance. |

| Why opt for digital nomad health insurance? | Discover why digital nomad health insurance is essential for remote workers, offering global coverage, access to private hospitals, and telehealth services. |

| Key benefits for digital nomads | Explore the key benefits of digital nomad health insurance, including emergency care, check-ups, mental health support, and emergency evacuation services. |

| How to choose the right plan? | Tips for choosing the right health insurance plan, including coverage for all destinations, medical benefits, mental health support, and compliance with visa rules. |

The risks of uninsured remote work

Remote work gives digital nomads freedom and flexibility, but without the right health insurance, it can also bring serious risks and high costs. Here are a few risks to keep in mind:

- Medical emergencies can happen anytime: No matter where you are, accidents or illnesses can happen. Getting sick abroad may mean facing new health problems, such as tropical diseases or unexpected injuries, that may need quick and expensive care.

- Local healthcare may not be reliable: Not all countries have the same level of healthcare. Some places may lack quality hospitals, while others may have language barriers. Without insurance, you might get poor treatment or struggle to get the help you need.

- High medical bills without insurance: Paying for healthcare on your own can be very expensive, especially in private hospitals. Costs for surgeries or emergency treatments can be overwhelming without insurance.

- Travel insurance is not enough: Many digital nomads think travel insurance is enough, but it usually only covers things like trip delays or lost luggage, and not regular doctor visits, ongoing health problems, or long-term care. What you need is international health insurance made for people living and working in different countries for longer periods.

Why opt for digital nomad health insurance?

Unlike travel insurance or local health plans, digital nomad health insurance is specifically made for people who live and work in different countries. It provides full, flexible, and worldwide protection that suits a nomadic lifestyle.

Digital nomad health insurance provides global coverage. As digital nomads are often on the move from one country to another, they need insurance that works worldwide. Good plans cover medical care in over 175 countries, including hospital stays, emergencies, and check-ups.

In addition, most plans provide access to private hospitals and doctors, often with world-class services and English-speaking staff. This makes it easier to get the care you need, especially while in a new country where the local system may be hard to understand.

These plans are also flexible and easy to manage. You can pay monthly, pause when you’re not travelling, or cancel anytime. This flexibility is perfect for digital nomads who move often or change plans quickly.

Many plans include telehealth and online doctor consultations, which are helpful if you’re in a remote area or can’t visit a clinic. You can also get mental health support and talk to a doctor for a second opinion.

Key benefits for digital nomads

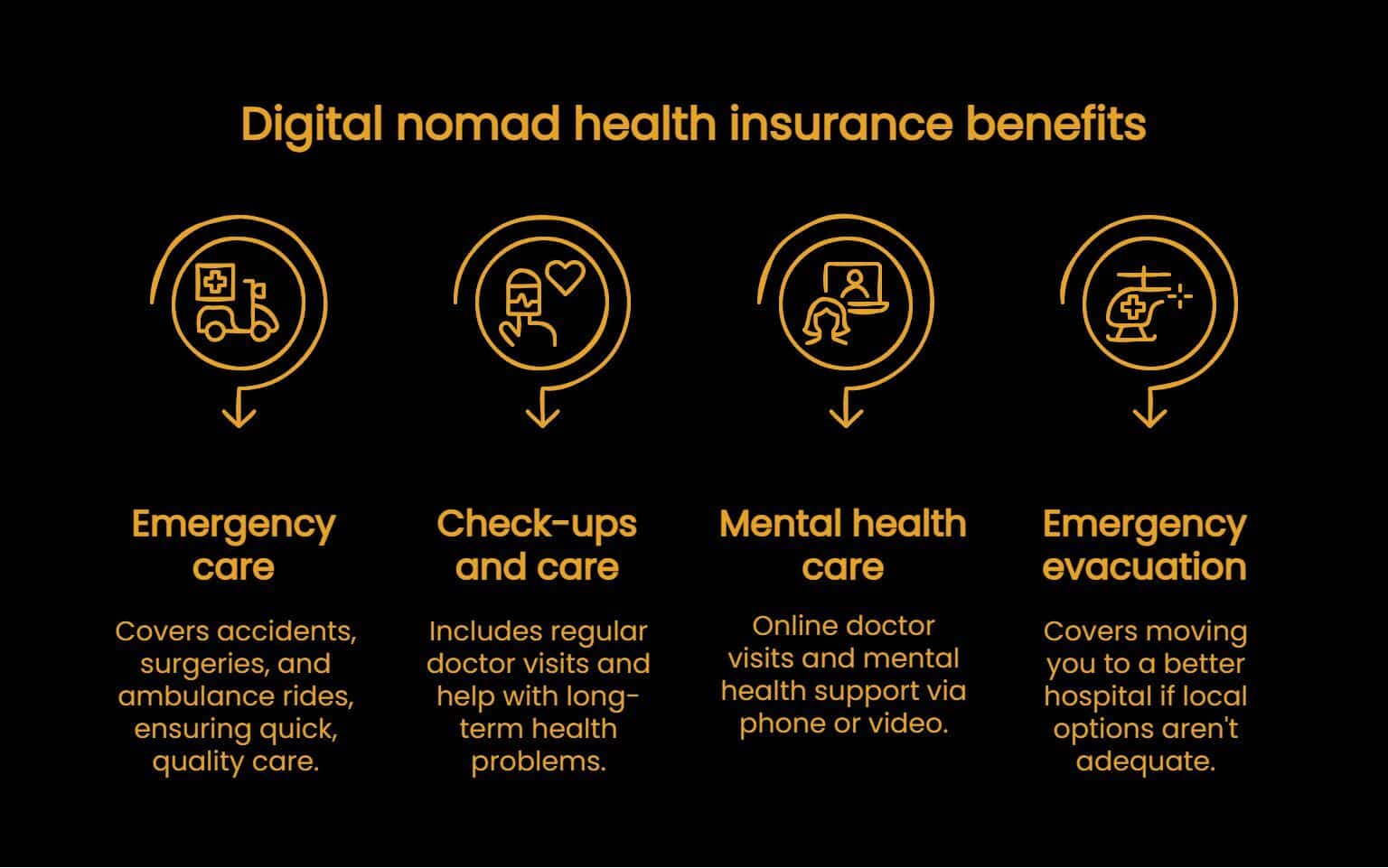

Digital nomad health insurance gives important protection for people living and working in different countries. These key benefits help nomads stay healthy and worry-free while on the move:

- Emergency care and hospital stays: Good plans cover emergencies such as accidents, surgeries, and ambulance rides, giving you quick and quality care without huge bills.

- Check-ups and ongoing care: Unlike basic travel insurance, these plans often include regular doctor visits and help with long-term health problems. This is important when moving from place to place.

- Mental health and online care: Many plans include online doctor visits and mental health support. You can consult a doctor or therapist by phone or video, which is useful if local healthcare options are not within reach.

- Emergency evacuation: If local hospitals aren’t equipped to treat you properly, the insurance covers moving you to a better hospital, saving you from high costs during serious health issues.

How to choose the right plan?

Picking the right health insurance is important for digital nomads who live and work in different countries. Here are some simple tips to help you choose a plan that fits your needs.

Make sure the plan covers all the countries you plan to visit or live in. Some plans provide global coverage, while others only cover certain regions. Always check if expensive or popular countries are included so you don’t face surprise costs.

Look for full medical benefits. A good plan should cover both hospital stays (inpatient care) and regular doctor visits, medicine, and check-ups (outpatient care). This helps you stay healthy and avoid big bills if you get sick.

Don’t forget to make sure that the plan fits your visa and travel regulations. Some countries ask for proof of health insurance to approve digital nomad visas. Check that your plan meets those rules, including coverage limits and emergency services. Also, make sure it’s easy to renew or cancel if your travel plans change.

Get help from Pacific Prime Thailand

Choosing the right plan can be confusing. Pacific Prime Thailand gives expert advice to help you compare options and find one that suits your health needs, travel plans, and budget. Their support makes it easier to get the right coverage for your lifestyle.

Pacific Prime Thailand is a well-known international insurance broker with over 25 years of experience. They focus on helping digital nomads, expats, and remote workers find the right health insurance for a mobile lifestyle. Here’s why Pacific Prime is a leading option for many:

- Works with top global insurers: Pacific Prime Thailand partners with leading insurance companies like Cigna, AXA, April, and Allianz. This gives you access to a wide range of plans that cover emergency care, doctor visits, routine check-ups, and extra options like dental and maternity care.

- Flexible coverage for changing travel plans: Digital nomads move often, so Pacific Prime Thailand offers plans that work across the world or in specific regions. Their coverage includes hospital stays, remote doctor visits, emergency evacuations, and care for long-term illnesses. You can also customise your plan to match your lifestyle and travel habits.

- Clear advice and full support: Their team gives honest, easy-to-understand advice to help you compare plans and pick the best one. They offer 24/7 customer service, support in many languages, and an easy-to-use system for making claims.

With strong coverage and helpful support, Pacific Prime Thailand lets digital nomads enjoy life and work abroad without stressing about healthcare. Their focus on flexible plans and great service makes them a reliable partner for life on the move.

As a digital nomad, your freedom shouldn’t come at the cost of your health. Having proper health insurance ensures peace of mind, access to quality care, and long-term protection. With support from Pacific Prime Insurance, staying healthy and secure on the road is easier than ever.

Get in touch with Pacific Prime today to find the right plan for your journey.

Sponsored

The story Why digital nomad health insurance is crucial for remote work as seen on Thaiger News.