With Netflix now in the lead position to acquire Warner Bros. Discovery, the streaming industry is looking at a structural shake-up that will shift competitive dynamics for years to come.

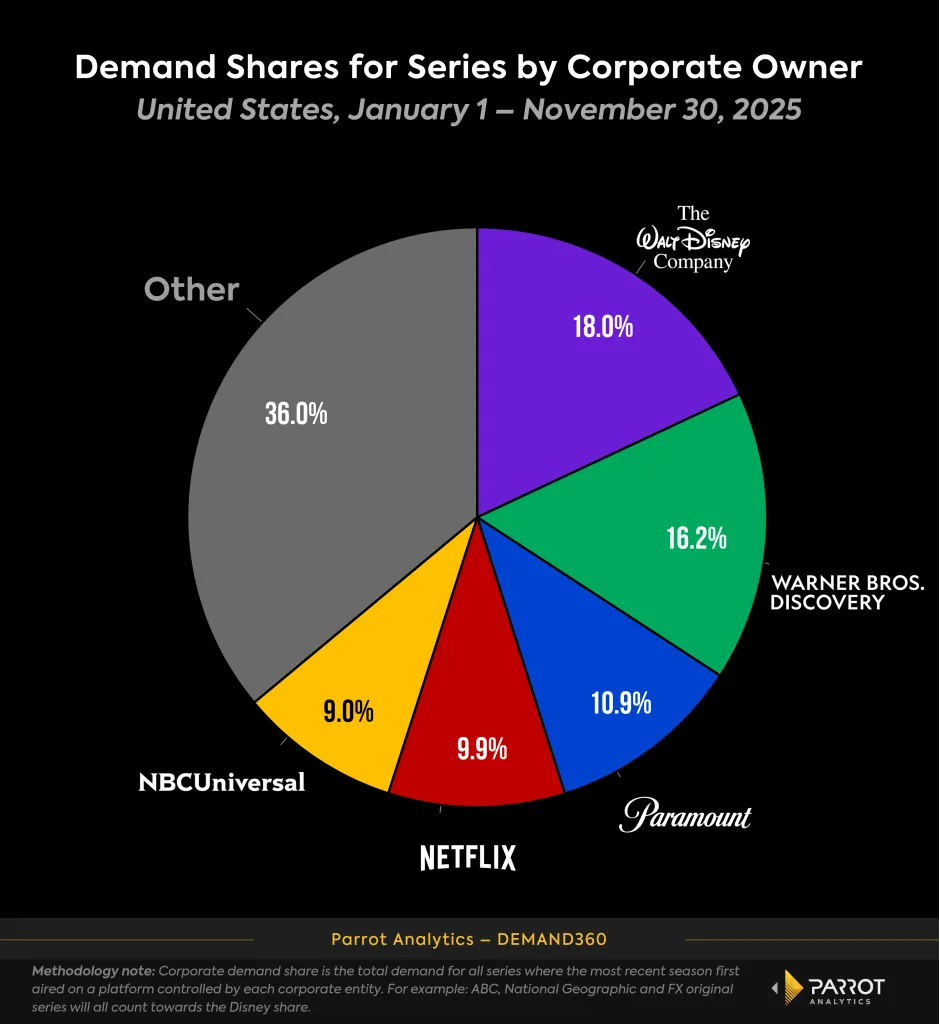

Parrot Analytics’ demand data at the corporate level underscores just how valuable WBD’s catalog remains in today’s attention economy. From January through November 2025, 16.2% of US demand for all TV series was for a title that falls under WBD’s corporate umbrella, second only to Disney’s 18%. The relative standing of the leading players in this metric has remained fairly stable since the WarnerMedia-Discovery merger. It is hard to drastically shake things up at the macro corporate level without M&A activity, but that is exactly what looks set to happen.

A merger between Warner Bros. and Netflix would produce a combined 26.0% demand share, instantly eclipsing Disney and creating a new leading content owner in U.S. television. A union between WBD and Paramount would create an even larger conglomerate with a 27.1% share of demand for series falling under its expanded corporate ownership, thanks to Paramount’s hefty catalog of legacy content.

Among the market leaders, all but Netflix have lost demand share since 2024, reflecting challenges to legacy media companies facing newer competitors. The corporate demand share for Amazon and Apple has also grown over this time (these aren’t broken out in the chart, but fall into the “Other” category). As digitally native players like these aggressively invest in original content, legacy companies will continue to lose market share.

For Netflix, acquiring WBD’s studio and streaming assets would accelerate its pivot into franchise IP, an area where it has historically lagged behind Disney and WBD. DC, Middle-earth, Harry Potter and HBO’s prestige pipeline would instantly give Netflix the deep, evergreen catalog it lacks while lessening its dependence on licensed content it does not own.

For Paramount, a WBD deal would be transformational. The combined entity would surpass Disney in demand share, creating a studio with unmatched breadth. Consolidating these companies’ streamers could be the catalyst to finally achieve scale. Paramount+ and HBO Max together could compete more directly with Netflix and Disney.

Netflix is dominating audience attention at the end of the year with the extended rollout of the final season of “Stranger Things.” So far, demand in the U.S. for “Stranger Things” peaked at 693 times the average series demand in the U.S. on Nov. 29, which is an all-time record demand for any show in the U.S.

The last time a non-Netflix show set a record high demand was in May 2019 during the “Game of Thrones” series finale, when that HBO series peaked at 375x the average series demand.

This encapsulates the shifting power dynamics we have seen over the past six years. In 2019, HBO was unmatched in its ability to create a must-watch cultural event. Now it is Netflix that can focus today’s fragmented audiences on that scale. An acquisition of WBD’s studio and streaming assets will solidify its leading position.

The post Netflix-Warner Bros. Combo Would Eclipse Disney’s 18% Share of TV Demand | Chart appeared first on TheWrap.