The Thaiger key takeaways

- Managing chronic conditions in Thailand requires health insurance that covers specialist visits, medications, tests, and hospital stays.

- Cigna offers high-coverage plans with access to top hospitals, direct billing, and telemedicine support for convenient long-term care.

- Expats should disclose pre-existing conditions, understand waiting periods, and ensure their policy meets visa requirements

Living in Thailand as an expat has many benefits, but managing chronic conditions like diabetes or asthma can be difficult. Language barriers, costs, and limited access to specialists can make things harder. That’s why having the right health insurance is important. Cigna offers plans that cover chronic conditions, giving expats reliable medical support and peace of mind.

On this page

| Section (Click to jump) | Short Summary |

|---|---|

| Understanding chronic conditions coverage | Chronic conditions last over three months and need ongoing care. Coverage includes doctor visits, medications, tests, and hospital stays for expats in Thailand. |

| Why choose Cigna for chronic condition coverage? | Cigna offers comprehensive coverage, access to top hospitals, high annual limits, direct billing, and specialist care, making long-term management of chronic conditions easier and affordable. |

| Important considerations for expats | Expats should disclose pre-existing conditions, understand waiting periods and premiums, ensure visa compliance, and take advantage of telemedicine and 24/7 support for convenience. |

Understanding chronic conditions coverage

Chronic conditions are long-lasting health problems that usually last for more than three months and need ongoing care. Common examples are diabetes, high blood pressure (hypertension), and lung diseases like asthma or COPD (chronic obstructive pulmonary disease). These conditions may get worse or improve over time.

For expats living in Thailand, having health insurance that covers chronic conditions is important because managing these diseases requires regular care. Health insurance typically covers:

- Regular visits to specialists

- Prescription medications

- Diagnostic tests

- Hospital stays if needed

Full coverage for chronic conditions is essential to avoid high costs from long-term treatment. Without proper insurance, expenses from doctor visits, medications, and emergency care can quickly become a heavy financial burden. Good coverage ensures access to quality healthcare and provides peace of mind, allowing expats to focus on their health without worrying about unexpected medical bills.

This is why many expats choose an insurance provider. They offer comprehensive coverage for chronic conditions, with access to top hospitals and specialists in Thailand, making ongoing treatment more affordable and easier to manage.

Why choose Cigna for chronic condition coverage?

For expats managing chronic conditions in Thailand, choosing the right health insurance provider is key to ensuring good, ongoing care. Cigna offers comprehensive coverage for chronic illnesses, designed to support long-term treatments. Their plans cover essential services such as:

- Specialist consultations

- Prescription medications

- Diagnostic tests

- Hospital stays

Cigna’s health insurance is known for its high annual coverage limits, which are perfect for the long-term treatments that chronic conditions often require. Depending on the plan, coverage can reach up to several million Thai baht per year, giving expats strong financial protection against high medical costs.

Cigna also provides access to a wide network of top medical providers and private hospitals in Thailand, including well-known hospitals in Bangkok, Chiang Mai, and Phuket. This means expats can choose trusted specialists and hospitals for their care, without any restrictions.

Another benefit is Cigna’s simple claims process. Many hospitals have direct billing agreements with Cigna, so policyholders don’t have to pay upfront and wait for reimbursement. This makes accessing medical care easier and reduces administrative hassle.

Also: 5 hospitals that digital nomads trust the most

Key features of health insurance for chronic conditions in Thailand

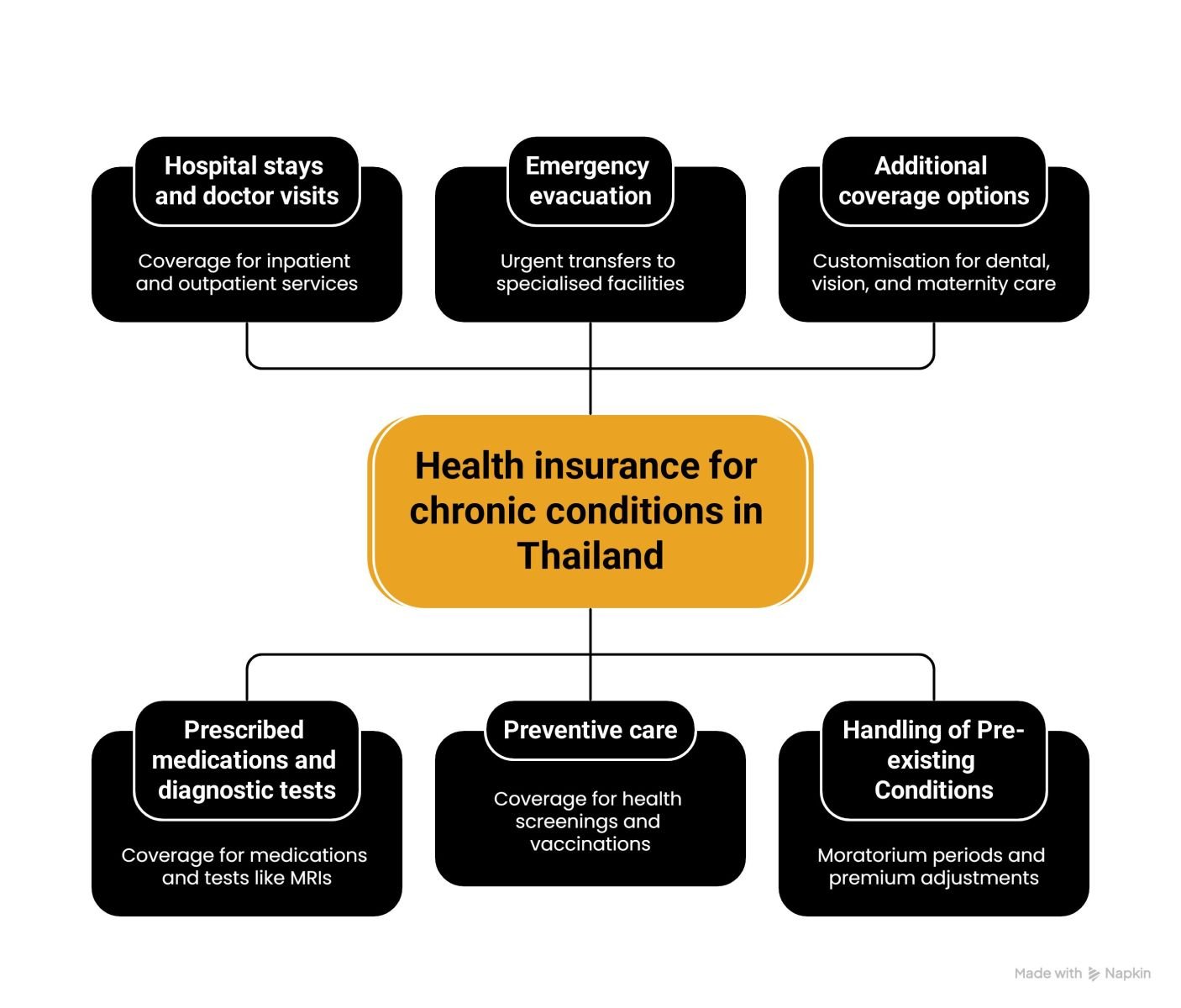

Health insurance plans for chronic conditions in Thailand provide broad coverage to meet the ongoing needs of long-term illness management. Here are some key features to look for:

- Hospital stays and doctor visits: Coverage for inpatient and outpatient services, including doctor consultations and necessary hospital stays.

- Prescribed medications and diagnostic tests: Plans cover medications and tests like blood work, MRIs, or X-rays, helping expats manage their conditions without high out-of-pocket costs.

In addition to routine care, many plans offer:

- Emergency evacuation: This benefit provides urgent transfers to specialised facilities, either within Thailand or internationally, when needed.

- Preventive care: Coverage for regular health screenings and vaccinations to catch health issues early and prevent complications from chronic diseases.

Top-tier plans also allow for customisation:

- Additional coverage options: Expats can add benefits for dental care, vision correction, maternity coverage, and even alternative treatments like acupuncture to suit their personal health needs.

For pre-existing conditions, insurers like Cigna are transparent in how they handle coverage:

- Moratorium periods: Coverage starts after a set time without claims.

- Premium adjustments: Some insurers may adjust premiums for pre-existing conditions to ensure fairness while keeping policies affordable.

It’s also important to understand exclusions, which may include treatments for cosmetic procedures, injuries from extreme sports, or conditions caused by not following medical advice. Expats should carefully review the terms and choose plans that offer lifetime renewability and strong support for chronic condition management.

Important considerations for expats

When getting health insurance for chronic conditions in Thailand, expats should keep a few key things in mind to ensure they’re fully covered.

- Full disclosure of pre-existing conditions: Always share your complete medical history, including conditions like diabetes or heart disease. If you don’t disclose pre-existing conditions, your claims may be denied or your policy could be cancelled. Insurers like Cigna need this information to assess risk and set premiums accurately.

- Waiting periods and premiums: Be aware of waiting periods, which is the time you must wait before certain conditions, especially pre-existing ones, are covered. Waiting periods can vary from a few months to over a year. Premiums for chronic condition coverage are often higher, but they provide essential protection for long-term care.

- Visa compliance: Thai immigration often requires proof of valid health insurance, including coverage for chronic conditions. Make sure your policy meets these requirements to avoid delays. Many insurers, including Cigna, provide the necessary documentation for visa applications.

- Telemedicine and 24/7 support: Many modern plans, like Cigna’s, offer virtual consultations with doctors and nurses, available around the clock. This makes it easier to get medical advice, prescription refills, and symptom monitoring without needing to visit the hospital, improving care and convenience.

Managing chronic conditions like diabetes, high blood pressure, and asthma in Thailand requires the right health insurance for ongoing care. Cigna offers plans that cover specialist visits, medications, tests, and hospital stays, with high coverage limits for long-term treatments.

These plans also give expats access to top hospitals and simplify the claims process with direct billing. It’s important to disclose pre-existing conditions, understand waiting periods, and make sure the insurance meets visa requirements. Many plans, like Cigna’s, also offer telemedicine for easy access to care. To learn more about what health insurance doesn’t cover in Thailand, check out our related article.

Also: The 60-second health check that could save your life

The story Thailand health insurance that covers chronic conditions: What expats need to know as seen on Thaiger News.