Getting injured in Thailand without insurance can lead to high medical bills and a stressful hospital visit. Private hospitals often ask for a big payment before giving treatment, while public hospitals might delay care if you can’t pay right away. This can cause both money problems and extra paperwork. Having good health insurance can help you avoid these issues. SafetyWing offers affordable international plans that cover emergency care and hospital stays, so you don’t have to worry about large costs. With the right coverage, you can focus on getting better instead of dealing with bills.

On this page

th, td {

padding: 10px;

text-align: left;

border-bottom: 1px solid #ddd;

}

th {

background-color: #f2f2f2;

font-weight: bold;

}

td {

background-color: #fff;

}

a {

text-decoration: none;

color: #007BFF;

}

a:hover {

text-decoration: underline;

}

| Location | Description |

|---|---|

| Immediate steps to take when injured | If injured in Thailand, get medical help quickly. Hospitals will provide emergency care but may ask for payment upfront. Choose between public or private hospitals based on cost and waiting time. |

| What to expect if you’re hospitalised in Thailand without insurance | Without insurance, you’ll be responsible for paying up front and managing paperwork yourself. Public hospitals may have long waits, while private ones may demand large deposits before treatment. |

| Why not having health insurance in Thailand is risky | Medical treatment without insurance can lead to high costs and delays. From emergency room visits to major surgeries, hospital bills can quickly exceed your savings, especially if you’re without coverage. |

| Why SafetyWing Nomad Insurance is a smart choice for travellers in Thailand | SafetyWing offers affordable, flexible insurance covering medical care, hospital stays, and emergency evacuation. It’s ideal for travellers and digital nomads in Thailand looking for peace of mind. |

| Tips for injured travellers without insurance | Keep an emergency fund, contact social workers in hospitals for payment plans, and consider contacting your embassy for assistance. Signing up for SafetyWing after arrival can ease your hospital experience. |

Immediate steps to take when injured

If you get injured in Thailand, the first thing to do is get medical help quickly. In serious cases, hospitals will give emergency care even if you don’t have insurance or can’t pay right away. Call 1669 for an ambulance—this number works across the country.

Next, you’ll need to choose between a public or private hospital:

- Public hospitals are cheaper and provide full medical services. But they can have long waits, especially for non-urgent care. Staff may not speak much English outside major cities. You might also need to pay before getting treatment that isn’t an emergency.

- Private hospitals give faster service, with English-speaking staff and more comfort. But they usually ask for a large payment up front—sometimes tens or hundreds of thousands of baht—before they treat you. They may also charge for using their own ambulance.

No matter which hospital you go to, you’ll need to show your passport or photo ID and proof you can pay, like a credit card or cash. If you don’t have these, treatment (except for emergencies) may be delayed.

Having travel insurance, like SafetyWing, can make things easier. It helps cover medical bills and supports you through the paperwork, so you can focus on getting better.

What to expect if you’re hospitalised in Thailand without insurance

If you end up in a Thai hospital without insurance, you’ll need to handle everything yourself—payments, forms, and communication. Here’s how to manage it:

1. Paying deposits and treatment costs

Hospitals usually ask for a big deposit before giving care. In private hospitals, this can be between 50,000 and 200,000 baht (around US$1,500–US$6,000), especially if surgery or a long stay is needed. Public hospitals might charge less but give priority to urgent cases and Thai citizens.

If you can’t pay the full amount, speak to the billing office. Some hospitals may let you pay in parts, but this depends on their rules and how you explain your situation.

Bring your passport and proof you can pay—like a credit card, bank records, or cash—before or during your stay.

2. Managing bills, discharge, and visa paperwork

Without insurance, you must pay the full amount before the hospital lets you leave. Some places won’t release you or your passport until the bill is paid. There’s no one to handle bills or pre-approve treatments for you.

Check your final bill carefully—it will list treatments, medicine, room charges, and more. Some hospitals ask for daily payments, while others bill you when you leave.

If you need to stay in Thailand longer to recover, you’ll have to take your medical papers to immigration yourself. Hospitals may help with documents, but you’re responsible for getting everything done correctly and on time.

3. Dealing with language and paperwork issues

Big private hospitals usually have English-speaking staff. But in public hospitals, English is limited. This can lead to confusion, delays, or mistakes. If possible, bring a Thai-speaking friend to help.

Some hospitals offer interpreters, but this isn’t always available—especially outside Bangkok. Make sure you understand what you’re signing. If something isn’t clear, ask questions.

You may face a lot of forms, waiting, and back-and-forth with hospital staff. Be patient and follow up often to avoid delays.

Helpful tip: Insurance like SafetyWing can make this process much easier. It helps cover medical bills and handles communication with the hospital, so you don’t have to deal with everything on your own—even if you buy it after arriving in Thailand.

Why not having health insurance in Thailand is risky

If you get sick or injured in Thailand without insurance, you could face serious financial problems and a lot of stress. Here’s what can happen:

High medical costs

Private hospitals, which many foreigners prefer, are expensive. A basic emergency room visit can cost US$100 to US$300. One night in the hospital may cost US$300 to over US$1,000. If you need surgery or ICU care, the bill can reach US$3,000 to US$10,000 or more. Big operations like heart surgery might cost between US$15,000 and US$35,000. Hospitals often ask for a large payment before treating you. Without insurance, you must pay everything yourself.

Delays or denied treatment

Hospitals will treat life-threatening cases first, even without payment. But for non-emergency care, you may be delayed or even refused if you can’t pay upfront. Private hospitals usually demand a deposit before starting treatment. Public hospitals may be cheaper but often have long waits and language issues.

No help with paperwork or problems

If you don’t have insurance, you have to deal with everything alone. That includes filling out forms, talking to hospital staff, arranging follow-ups, and paying bills. Public hospitals may not have English-speaking staff, making things harder. You’ll also have no help if you need an emergency flight home, which can cost tens of thousands of dollars.

Possible debt or needing help from your embassy

If you can’t pay your hospital bills, the hospital might delay your release or hold your passport until you pay. Some people must ask their family or embassy for help, which takes time and can be very stressful. Without insurance, you risk going into serious debt or leaving treatment unfinished.

Having insurance like SafetyWing can protect you from these problems. Their plans cover emergency care, hospital stays, and even emergency evacuation. They also help with payments and paperwork, making your hospital experience safer and less stressful.

Why SafetyWing Nomad Insurance is a smart choice for travellers in Thailand

SafetyWing Nomad Insurance gives you simple, affordable health coverage while living in Thailand or travelling around the world. For about US$2 a day, it protects you from big medical bills if you get sick or injured—something that can be very expensive without insurance.

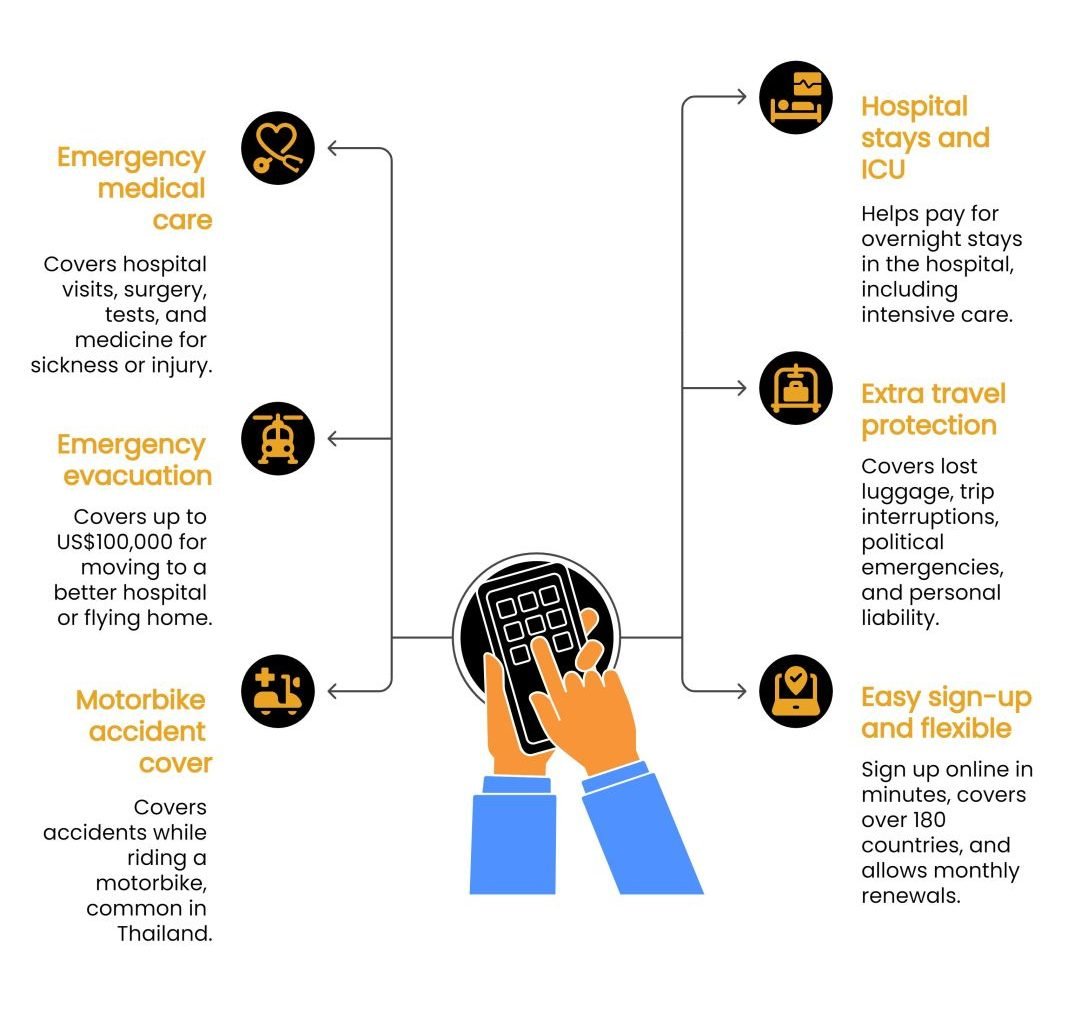

Emergency medical care

If you get sick or injured, SafetyWing covers hospital visits, surgery, tests (like X-rays or MRIs), and medicine. This is important in Thailand, where private hospitals often ask for big deposits before they treat you.

Hospital stays and ICU

The insurance helps pay for overnight stays in the hospital, including intensive care, so you don’t have to pay large amounts out of pocket while you recover.

Emergency evacuation and going home

If you need to be moved to a better hospital or flown back to your home country, SafetyWing covers up to US$100,000. Without insurance, this could cost tens of thousands of dollars.

Extra travel protection

SafetyWing also covers things like lost luggage, trip interruptions, political emergencies, and personal liability—so you’re protected beyond just medical issues.

Motorbike accident cover

Motorbikes are common in Thailand, but many insurance plans don’t cover accidents. SafetyWing does—this makes it especially useful if you ride a motorbike during your stay.

Easy to sign up and flexible plans

You can sign up online in minutes—even after you’ve already arrived in Thailand. The plan covers over 180 countries and allows for monthly renewals, making it well-suited for individuals who frequently relocate.

SafetyWing helps take the pressure off during emergencies. It covers major costs and makes hospital visits and paperwork easier, so you can focus on getting better—not worrying about money. It’s a smart, simple way to protect your health and your budget while living or travelling in Thailand.

Tips for injured travellers without insurance

Getting injured without insurance in Thailand can be stressful and expensive, but there are a few smart steps you can take to handle the situation better:

1. Keep an emergency fund

Always try to have at least US$3,000 (around 100,000 baht) saved for medical emergencies. Hospital bills can add up quickly—from a few thousand baht for small treatments to tens of thousands for surgery or ICU care. Having cash or a credit card ready can help you pay hospital deposits and avoid delays in treatment.

2. Talk to hospital social workers

Most hospitals have social workers who can help patients with money problems. Explain your situation clearly—they might offer payment plans, connect you to charity help, or guide you through the paperwork. Being honest and polite can make a big difference.

3. Contact your embassy

If you can’t pay your medical bills or need help fast, your country’s embassy or consulate in Thailand can support you. They can help speak with the hospital, offer advice, and may even help you contact your family or apply for emergency loans.

4. Consider buying SafetyWing after arrival

Even if you didn’t get insurance before coming to Thailand, you can still sign up for SafetyWing online. Plans start at around US$2 a day and cover new medical emergencies, hospital stays, and even emergency evacuations. It can also help with hospital payments and take away some of the stress of dealing with bills on your own.

Getting hurt in Thailand without insurance can lead to big medical bills, long waits, and a lot of stress. Private hospitals often ask for a large payment before giving treatment, and public hospitals may delay care if you can’t pay right away. If you don’t have insurance, you’ll need to handle everything yourself—paying bills, filling out forms, and dealing with hospital staff. This can be hard, especially if there are language problems. SafetyWing is an easy and low-cost option that covers emergency care, hospital stays, and even motorbike accidents. You can sign up anytime, even after you arrive in Thailand. If you want to learn more about why health insurance matters for people living abroad, check out this article: Why health insurance for digital nomads is more important than ever.

Sponsored

The story What to do if you get injured in Thailand without insurance? as seen on Thaiger News.